It’s no news that Asheville-area housing costs keep climbing. In the last five years, the median sales price for site-built, single-family homes in Asheville jumped from $210,000 to $315,000, according to Multiple Listing Service data. That’s left many longtime city residents shaking their heads in wonder, and even some new arrivals may be surprised by what they find here these days.

One strategy for homebuyers is simply to spend more.

“People will call me all the time and be like, ‘I want a house on the side of the mountain with a view and an acre and 2,500 square feet for $300,000,’” says Hadley Cropp of the Asheville Realty Group. “I’m like, ‘That’s a unicorn; it doesn’t exist.’” Typically, she says, her clients then re-evaluate and end up increasing their budget.

But that’s not an option for a lot of folks. And for many buyers, part of the problem is the disparity between local incomes and home prices. According to an economic snapshot by the N.C. Justice Center’s Budget & Tax Center, 36.5 percent of Buncombe County residents are considered low-income. The living wage for the county, says local nonprofit Just Economics, is $13 an hour ($11.50 with employer-provided health insurance), and many local workers earn below that figure.

“For most people that are making just that ‘living wage,’ homeownership is out of reach,” says Executive Director Vicki Meath. “One of the reasons that Just Economics is in existence is the disproportionately high cost of living, particularly housing and low wages.” Those factors, she says, “are quickly causing gentrification in our city. And it’s pushing further and further out into the county.”

Of course, for buyers who’ve just moved here after selling a home in a more expensive market, Asheville real estate may still seem like a bargain. And retirees who bring their income with them don’t have to worry about local wages.

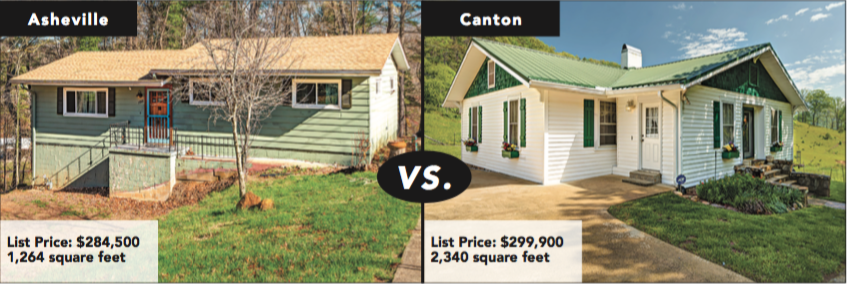

Increasingly, however, first-time homebuyers and those on tighter budgets are venturing past the city limits into outlying areas of Buncombe and beyond. “Prices in the city of Asheville have gotten so out of hand that people are going out into the county, out into Woodfin, Weaverville, places like that,” says Mike Miller, co-owner of Town and Mountain Realty. That’s particularly true, he notes, “for first-time buyers or people in the $200,000 to $350,000 range.”

Neal Hanks, president of Beverly-Hanks & Associates in Asheville, believes Buncombe’s quick recovery from the 2008 recession has contributed to the tightening of the local housing market.

“As that [existing] inventory has been absorbed, it makes it harder for folks to find what they’re looking for, particularly in their price range,” he points out. “We’ve had faster appreciation in Buncombe County and Henderson County than we’ve had in the surrounding markets, so the surrounding counties are catching up.”

Full-time job

After a fruitless search in Asheville, local artist Anna Johnson found a home in Woodfin that met her specifications. “My budget was under $200,000, and I wanted to have the option to have a roommate, so I was basically looking for anything that was two-bedroom, one-bath,” she explains.

Johnson, a jewelry maker, also wanted a yard and a setup that would enable her to work from home. A small, separate building on her Woodfin property now serves as her studio.

The artist says she looked in West Asheville, but most of the homes in her price range would have needed immediate work. “I wanted to be realistic, in that I wouldn’t be able to buy a house and instantly drop $5,000 or $10,000 on things,” she explains.

That was two years ago, though — and even then, she says, the amount of work it took to find and buy a house felt like taking on a second full-time job. Meanwhile, prices in Woodfin have also increased: The median selling price for a site-built, single-family home is now about $280,000.

As a result, more folks are shifting their focus to other parts of the county.

Cindy Ward, who owns Weaverville Realty, says she sees many people who move here with their hearts set on Asheville but end up looking elsewhere. “That’s where we’re starting to see the attention for the outlying areas: Candler, Leicester, Weaverville and Fairview,” she says, adding, “There’s no shortage of beautiful spots in Buncombe County.”

In the last five years, however, both home sales and prices have climbed in those areas as well. In Candler, for example, the median selling price jumped 45 percent during that period, and sales increased 62 percent. In Leicester, prices climbed 74 percent, and sales were up 112 percent.

Spilling over

Other buyers, meanwhile, are extending their search beyond the county line. Brian Cagle, president of the Haywood Realtor Association, says his area typically sees two kinds of homebuyers: retirees and overflow from Western North Carolina’s biggest city. Asheville, he points out, “is very close, and for people that are used to living in urban areas, a 30-minute drive is nothing. If you live in Charlotte, you’re going to drive that far or longer to get to work.”

In Haywood County, notes Cagle, the total number of single-family homes sold has increased significantly over the past few years, from 743 in 2014 to 1,079 in 2017. Meanwhile, the number of days a house stays on the market has dropped sharply, from 241 in 2014 to 152 in 2017, and the median sales price has jumped from $151,500 to $194,000.

Scott Barfield sees a similar phenomenon playing out in Henderson County. “City planners and folks nationwide label certain markets as these incredibly trendy places to live, and Asheville qualifies as one of those,” says Barfield, who is president of the Hendersonville Board of Realtors. “And so the … communities around it begin to catch that flavor also.”

Like Hanks, Barfield says the impact of Asheville’s quick recovery from the recession has gradually spread to neighboring counties. “Henderson’s market has recovered to where it’s very common for us to see three offers on the same house,” he reports. Between 2016 and 2017, the county’s average sales price shot up about 12 percent — a far cry from the typical 2 or 3 percent change, he says, calling it “a showstopper.”

Bustling Buncombe

That doesn’t mean the Buncombe County market is down, however. Between March 17, 2017, and March 16, 2018, 3,572 homes were sold, according to MLS data — by far the most of any county in the region and up 40 percent from five years earlier.

Buncombe is also seeing healthy growth in housing stock. Between 2012 and 2017, the total number of building permits issued per year for single-family homes grew by more than 100 percent, from 398 to 891, according to information provided by Buncombe County.

Multifamily residential construction has shown a similar trend. During the same period, the number of such permits issued per year jumped from one in 2012 to 25 last year. The total number of residential units in those developments also spiked dramatically, from four in 2012 to 512 five years later. Over that time span, the peak year was 2016, with 43 buildings featuring 1,136 units.

Asheville has also seen steady growth in the number of construction permits issued for single-family homes, climbing from 204 in 2012 to 392 in 2016 before dipping to 331 last year. Permits for multifamily developments have been more erratic, peaking at 65 in 2013 before plummeting to just 10 three years later.

At the same time, however, both the city and county have seen significant declines in the number of homes for sale, even as the median sales price has continued to rise.

In any given year, the number of active listings for single-family homes tends to fluctuate, typically peaking during the summer and slumping in winter. But between January 2013 and January 2018, the number of active Buncombe County listings shrank by 25 percent, from about 2,000 to fewer than 1,500, MLS data show.

First-time homebuyers

Kathryn Beach, a certified financial and housing counselor with OnTrack WNC, sees a lot of first-time homebuyers come through her doors. Before sitting down with Beach, these clients have already taken the nonprofit’s homebuyer education classes.

One single mom from Asheville has been scouring the city for a suitable house that fits her roughly $180,000 budget. “She’s been looking for, I think, two to three years now and hasn’t been able to find anything in that price range where she wants to live,” says Beach. “She’s perfectly qualified — she has great credit, she has the income there and not a lot of debt — but the issue is just finding the price here.”

Those rising prices reflect the city’s increasing popularity, and for longtime residents, that growth has seemed dramatic.

“Explosive is an understatement,” says Jordan Barlow, a catering and conference services manager at Biltmore Estate. “When I was younger, you could lay out in the middle of downtown Asheville or on the city streets and nobody would run you over. Nowadays you can’t do that: too many people.”

Barlow, a single female in her 20s, recently bought a home in Henderson County, benefiting from a course she took at OnTrackWNC and a small subsidy she received from her employer. She wanted a place in Asheville but had trouble finding anything that fit her roughly $220,000 budget. “Within the next 10 years, when I look to upgrade, I definitely anticipate getting a little bit closer to the city,” she explains.

One way to offset the rise in prices is to redefine the type of home you’re looking for. “For many first-time buyers, manufactured homes are all they can afford, so that is what they buy,” notes Steve Heiselman of Town and Mountain Realty. “These homes have also become popular for retirees on fixed incomes who are relocating to our area and downsizing.” But manufactured home values are much more volatile, he cautions, and in the long run, they “will be a less lucrative investment than site-built homes.” In Candler, for example, “Site-built homes have appreciated about 18 percent since 2008, and manufactured homes have appreciated at a rate of 5 percent, including the market bubble depreciation and recovery.”

Clearly, however, not everyone is getting priced out of Asheville.

First-time buyers Ferrell and Koral Alman recently bought a house in West Asheville. The couple, notes Ferrell, had rented for two years “to kind of decide which neighborhood we wanted to end up in permanently.”

The Almans were considering homes in a couple of different price points — something in the mid-$200,000s that they’d have to put some work into or something in the mid-$300,000 range that would be move-in ready. They opted for the latter.

Having moved here from Los Angeles, where a two-bedroom, one-bath house downtown could cost $1 million, “It was relative to us when we moved to Asheville and people were talking about the exorbitant housing prices here,” Ferrell explains. So while he concedes that there’s a big disparity between wages and home prices in Asheville, “For us, we didn’t have as much sticker shock.”

Looking ahead

But with demand remaining strong, don’t expect local house prices to drop anytime soon. The area, says Cropp of the Asheville Realty Group, has what her clients are looking for: a temperate climate and panoramic mountain views. “Even though it seems like it’s getting more expensive to us, it’s still affordable in their eyes because they’re coming from Miami or New York, where prices are just insane.”

And many of those clients are retirees who can afford to buy a home here without needing a mortgage. Often, they’re downsizing or are what she calls “halfbacks.”

“They started in New York, they retired down to Florida, Florida was too hot for them so they’re coming halfback: halfway up the East Coast.”

Hanks, meanwhile, thinks the spillover to neighboring counties is also likely to continue. “The surrounding counties, which for decades have been very rural in nature, are more and more becoming suburbs of Asheville, and I think that trend’s just going to continue,” he points out. “You’ve just got a whole lot more room to grow.”

But for folks who are determined to live in Asheville proper, there’s another potentially effective strategy that may require more patience than money. By repeatedly buying and selling homes — and timing those transactions to turn a profit and build equity — those with sufficient stamina (and a bit of luck) may eventually get what they’re looking for.

When Jenn Clary, for example, bought a home in South Asheville, it was her seventh home purchase. Without the equity built up through those prior purchases, Clary believes it would have been hard for her to afford the South Asheville house. She recently moved again, however, wanting to be closer to Hendersonville, where she works as a physical therapist assistant.

Prices being where they are, Clary foresees first-time homebuyers having difficulty breaking into the Asheville housing market. “I have a 19-year-old son,” she says, “and I have pretty much told him, ‘If you’re not lucky enough to get something from your father and I … you’re probably not going to have access to buying a home if you want to be somewhere like Asheville.’”

yes, and city increased density substantially too! land now worth way more in the city.

Only in Asheville do people feel entitled to live in the most desirable parts of the city for cheap prices. Move out into the county if you want something cheap. Being close to town is desirable and as a result the cost reflects it. Just like any other city.

Thank you for the excellent write-up. We’re available to help with real estate planning anytime.

When the NC DOT decides to widen the interstates and roads in Asheville and Hendersonville no one can afford to live in any of the city limits. Weaverville city limits homes are outrageous and so are Woodfin’s. As jason stated above, move out to the county and hope you find a home that is not in a family clan.

We moved to NC from Texas to be close to our daughter who lives in Asheville, only to find out we can’t afford a simple 3bdr, old , not even updated . Definitely should have done my own digging around about the market.