Press release from Lattice Newswire:

Rising rents have hit households hard over the last year. After remaining flat amid eviction moratoriums and government assistance programs in 2020, rents grew by 17.6% in 2021 and by another 6.7% over the first seven months of 2022. And in a period of persistent inflation, costs for housing are squeezing renters’ budgets for other household spending.

But even before the recent spike in rents, the gap between what a typical rental costs and what the typical worker can afford based on their income has been growing. Amid stagnant wages for workers, especially low income earners, and a nationwide shortage of housing stock, renters are finding it more difficult than ever to secure affordable housing. A recent report from the National Low Income Housing Coalition found that the typical renter today needs to earn $21.25 per hour to afford a modest one-bedroom apartment.

The gap is only widening as rates of rent growth exceed rates of growth for wages. After adjusting for inflation, the median U.S. rent has grown by 25% since 2014, while the median hourly employee earnings in the U.S. has increased by only 6% over the same span. While the gap narrowed in 2020, the recent spike in rents has widened the difference between cumulative rates of rent and wage growth to nearly twice what it was before the pandemic.

The combination of rising rents and stagnant wages has been a challenge for Americans of all stripes, but certain groups have been more disadvantaged by this state of affairs than others. Researchers from the Joint Center for Housing Studies at Harvard found earlier in 2022 that nearly a quarter of the lowest-earning renters are behind on rent, and renters of color are at least twice as likely as white renters to be behind. But even well-off households are feeling pressure, as rising real estate costs price would-be buyers out and keep them competing for space in the rental market—and as they spend more on rent, they have a harder time saving for homeownership.

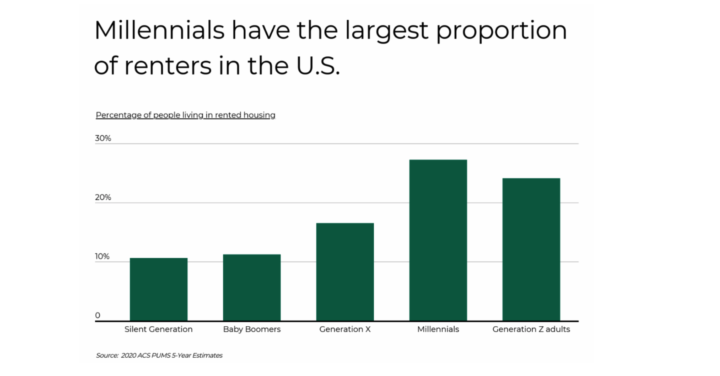

Current challenges in the rental market are also being experienced differently across generations. Members of the millennial generation—currently aged 26 to 41—are at an age when most people buy their first or second home. But rising costs of rents and real estate have compounded on other financial difficulties faced by the millennials, like lost earning potential after the Great Recession and historically high levels of debt. Now, 27.2% of millennials in the U.S. are renters, a larger proportion than any other generation.

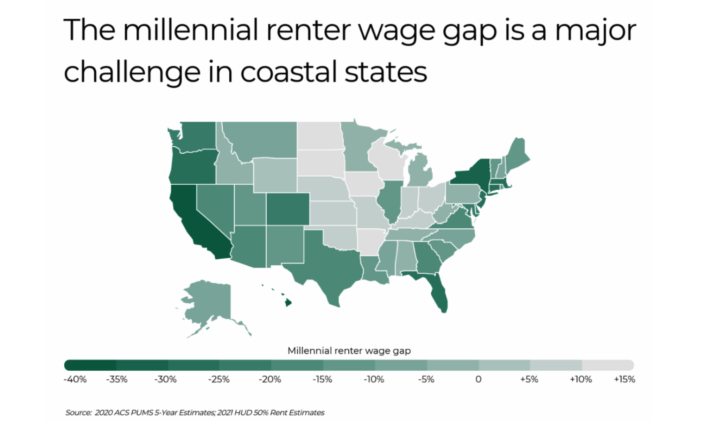

For millennials in some parts of the country, rental units fortunately remain relatively affordable. The interior of the U.S. tends to have the most affordable locations, including 13 states where a typical millennial renter’s earnings exceed what is needed to afford the median one-bedroom unit. In contrast, most of the states where millennials have larger renter wage gaps are coastal states that tend to have higher housing costs due to limited supply, like California. The problem is even more acute at the metro level, where some of the most desirable and fastest-growing cities in the U.S. have major renter wage gaps for millennials.

To determine the locations with the largest millennial renter wage gap, researchers at Filterbuy calculated the percentage difference between the median wage for millennial renters and the median wage necessary to afford a one-bedroom rental without spending more than 30% of wages on rent. In the event of a tie, the location with the higher median one-bedroom rent was ranked higher.

The analysis found that the wage needed to rent a one-bedroom unit in the Asheville metro area is $44,880 per year—39.3% more than the median annual wage of $27,225 for millennial renters there. Out of all midsize U.S. metros, Asheville has the 6th largest millennial renter wage gap. Here is a summary of the data for the Asheville, NC metro area:

- Millennial renter wage gap: -39.3%

- Millennial renter median wage: $27,225

- Annual wage needed to afford a 1-br rental: $44,880

- Median 1-br rent: $1,122

- Percentage of millennials in rented housing: 27.5%

Before you comment

The comments section is here to provide a platform for civil dialogue on the issues we face together as a local community. Xpress is committed to offering this platform for all voices, but when the tone of the discussion gets nasty or strays off topic, we believe many people choose not to participate. Xpress editors are determined to moderate comments to ensure a constructive interchange is maintained. All comments judged not to be in keeping with the spirit of civil discourse will be removed and repeat violators will be banned. See here for our terms of service. Thank you for being part of this effort to promote respectful discussion.