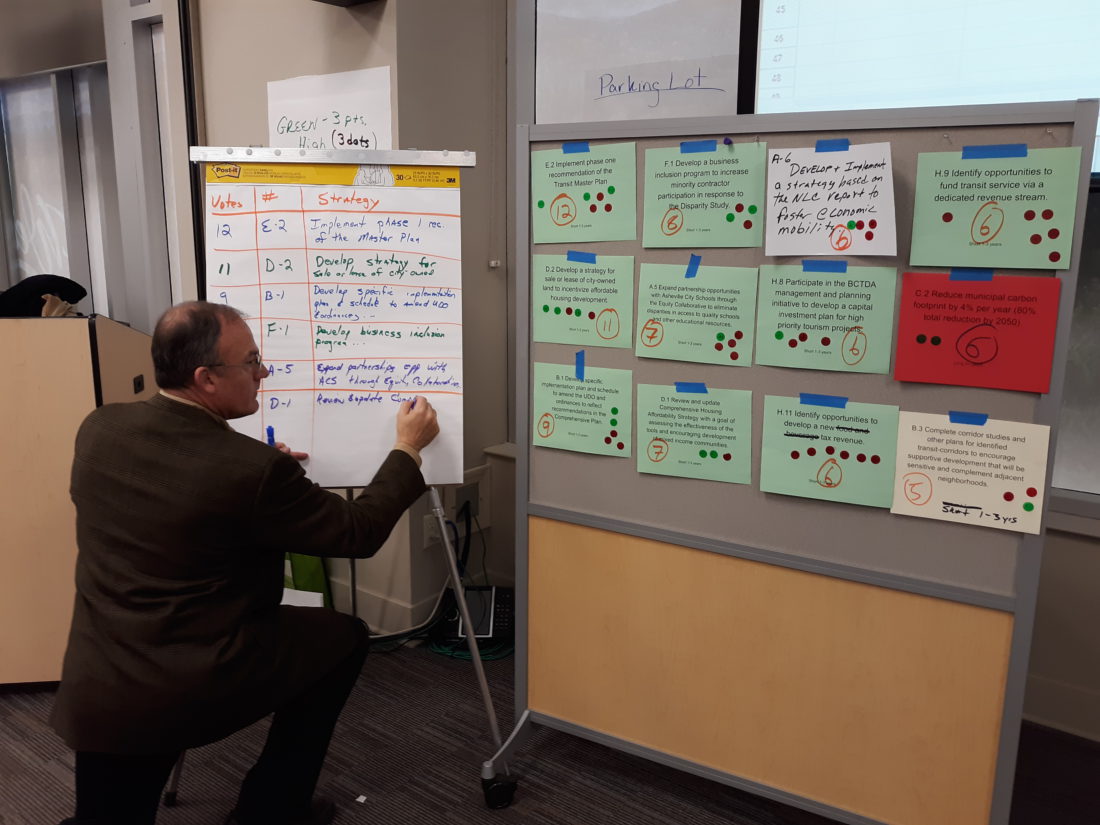

The story of Asheville City Council’s annual retreat, held this year on March 8 at the Buncombe County administration building, came down to two sets of colored dots. The first, a collection of green and red sticky markers plastered on pieces of paper with Council’s strategic goals, prioritized the group’s ambitions. The second, projected on financial charts in orange and blue, made some Council members doubt whether they could achieve any of those ambitions at all.

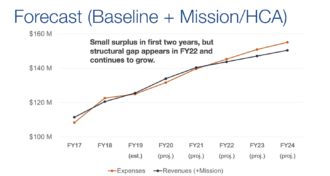

Even accounting for an estimated $8 million in new annual tax revenue starting in fiscal year 2021 — the spoils of the purchase of nonprofit Mission Health by for-profit HCA Healthcare — city staff projects that Asheville will take in less than it spends on operations by fiscal 2022. That structural gap will open solely as the result of cost increases for existing city services and does not include the impact of additional programs.

Council’s green and red priority dots highlighted new initiatives such as implementing the Transit Master Plan, eliminating disparities in Asheville City Schools, amending the zoning code and developing a business inclusion program for minority city contractors. But Council member Keith Young called the fiscal reality “sobering” as he addressed those who might seek funding for specific projects.

“This may hurt some feelings, but you can no longer operate the city of Asheville like it’s the Oprah Winfrey talk show, where you get a car and you get a car,” Young said, referencing the daytime TV host’s famous giveaways. “As much as we love all these programs and trying to help the public good … this is the time to close the bank.”

Vice Mayor Gwen Wisler went a step further, indicating that the city may have to cut some of its existing programs to ease the budgetary strain. “This scares me to death,” she said. “This is the year that we also have to start looking at some of the things that we’ve funded in the past and really making sure that everything we’re doing right now is consistent with our mission, down to the $50,000 items.”

Dancing with deficit

Tony McDowell, the city’s budget manager, explained that Asheville’s predicament is not unique among North Carolina cities. Municipalities in the state must rely on property taxes as their primary source of revenue, he said, and increases in property value “just can’t keep up with expenses.”

Labor expenses are among Asheville’s biggest cost drivers, McDowell said. State-mandated increases in employee retirement contributions, for example, will cost the city roughly $600,000 next year and continue to grow over the next three years. Asheville also faces nearly $28 million in unfunded retiree health care liability, although the city’s trust fund for that purpose contains over $9.5 million.

Without the infusion of the Mission/HCA taxes, McDowell noted, the city’s expenses would have exceeded its revenues starting in fiscal 2020. The exact amount Asheville will receive from the health system remains uncertain due to a pending appeal of its Buncombe County tax valuation.

City staff members also say Asheville should be preparing for the end of its current boom period. “We’re very far into an economic growth cycle,” warned McDowell. “There’s the potential that there’s going to be a recession sometime in the next five years. It’s likely there will be; nobody really knows when it’s going to happen right now.”

Mayor Esther Manheimer said the city had long wrestled with such situations, noting that Lauren Bradley, former executive director of finance and strategic planning, presented a similar slide at budget meetings as far back as mid-2011. “But I think it’s really important to ground us, to remind us, that this is the trajectory unless you alter it by either making cuts or raising taxes or finding efficiencies,” the mayor added.

Something’s gotta give?

Council members appeared to be divided over which of those strategies to pursue as they reckoned with the budget. In contrast with the possible need for cuts, as Wisler suggested, Julie Mayfield argued that Asheville couldn’t afford to stop any of its current work.

“What it really comes down to is, who are some of the people that we have that maybe we don’t need anymore?” Mayfield asked. “I didn’t come up with anything.”

Instead, Mayfield said the budget crunch highlighted the importance of boosting city revenue. “Nobody likes to talk about [it], and it’s not politically popular, but we can increase property taxes,” she noted. Manheimer also said she would “go to bat and work on additional revenue sources,” including a quarter-cent sales tax devoted to transit funding.

Young countered that a property tax increase would work at cross-purposes with other city programs. Efforts such as the Down Payment Assistance Program and for-sale affordable condominiums on city-owned property at 360 Hilliard Ave., he said, are designed to help low-income individuals become property owners — the same individuals who would be hit hardest by a tax bump.

“We’re talking about people who are the least among us, who are just now getting a slice of the pie,” Young said. Hiking property tax rates, he continued, would be like the city saying,“‘We know you barely got here, but we want you to pay a little bit more because somebody else wants another car. And this is the Oprah show, so we gotta make sure that everybody gets what they want.’”

“It’s not who gets a car,” Mayfield responded. “It’s whether transit, which is unanimously our No. 1 priority, gets an infusion of $3.5 million this year and ongoing and then continues to expand.”

Council member Vijay Kapoor, while not weighing in about possible changes to the property tax rate, suggested that Asheville should develop an ongoing general obligation bond program as “part and parcel” of capital funding. Brian Haynes and Sheneika Smith, who with Young voted against the city’s current budget in June, offered no comments during the budget discussion.

Red light

An important takeaway from the budget talk, suggested City Manager Debra Campbell, was that Asheville doesn’t need to make drastic decisions immediately. Thanks to the Mission/HCA taxes, she said, Council and staff members have a bit of breathing room to plan. “While we’ve got this window, we’re going to work really, really hard,” she emphasized.

“It’s a window, but it’s a window only if, for instance, we don’t do anything to implement the Transit Master Plan,” Mayfield pointed out. “If we do something to implement the Transit Master Plan, that window closes.”

Council will continue to work on the budget throughout the coming months. The body’s first budget work session takes place on Tuesday, March 26, followed by a second session and the adoption of city fees on Tuesday, April 9. A public hearing will take place on Tuesday, May 28, and final adoption of the fiscal 2020 budget is scheduled for Tuesday, June 11. Reaching that conclusion, said Young, will not be easy.

“If we don’t get it together, you’re going to be dealing with a lot more than telling somebody no,” Young warned his colleagues. “We’ve got to work with what we have now. The community knows this is not a fiscally hawkish, conservative Council. But looking at this, we need to be.”

The fact that the city is anticipating an $8 million dollar annual windfall from the HCA/Mission purchase yet still are facing a substantial budget gap is telling.

Even more telling is Council’s seemingly surprised reaction. Only Keith Young has a grasp on the situation ” The community knows this is not a fiscally hawkish, conservative Council. But looking at this, we need to be”

Rather than trying to be creative, looking for efficiencies or doing what must be done- cutting expenses, lookout for another property tax increase plus a sales tax increase because that is the easy answer. The $8 million from HCA should be earmarked for the $28 in unfunded retirement obligations until fully funded. Kicking that can down the road is only going to hurt more in the long run. The city was able to (poorly) operate without that $8 million before and should not rely on it to close the gap caused by multiple generations of council’s fiscal negligence.

Be creative – The BCTDA is sitting pretty with reserves like Fort Knox. In 2018 the city appropriated over $4 million to the Civic Center. I would suggest dropping that to $0 and pushing the BCTDA to pick up the difference. The events held there are crucial to the hotels and it would be foolish of them not to pony up.

Council – be creative, be efficient, be lean. Time to lead fiscally and not emotionally.

Here’s a thought. Leave people alone. Stay out of their property rights. You can’t complain about the TDA when they have a monopoly on hotels while banning STRs at the same time. It’s as if council plays nice guy while hoping the TDA will respond in kind. Yet all they’ve done is used council to enrich themselves. So do away with the STR ban, collect taxes and fees from them and then watch how the TDA behaves. I’m guessing they’ll have a change of heart as to how much money they give back to the community that has been footing the bill for way too long.

Wouldn’t the occupancy taxes paid by STRs still go to the TDA?

No, why would they?

Because STRs have to collect the same occupancy taxes that hotels do and remit them to the county, who in turn gives it to the BCTDA? I’m not saying it is right, just that it is the way it happens.

From the Buncombe county website

https://www.buncombecounty.org/governing/depts/tax/occupancy-tax.aspx

The Buncombe County Commissioners have levied an Occupancy Tax of 6% percent on gross receipts derived from the rental of any room, lodging or accommodation furnished by a hotel, motel, inn or similar place within the County.

The Occupancy Tax also applies to rooms or houses rented by individuals through websites including, but not limited to, Airbnb, VRBO, Windu, Rooorama, etc. The tax does not apply to accommodations furnished by nonprofit charitable, educational, benevolent or religious organizations when furnished to further their nonprofit purpose. The tax also does not apply to accommodations furnished to the same person for at least ninety (90) consecutive days.

Then from the BCTDA Website

https://www.ashevillecvb.com/history-of-bctda/

In 2013, the Buncombe County Finance Department eliminated the five room minimum, thus requiring all lodging properties to remit occupancy tax.

This does bring up an interesting point though, since the BC Finance Committee eliminated the minimum, maybe they could reinstate the minimum. Then charge a *fee* to the STRs equal to the occupancy tax and collect it for the county and city?

Unfortunately, it is going to be much worse than even these people think. The upcoming recession (already started) is going to be a “doosey”. Tourism will drop significantly and you’ll see businesses closing downtown and around. The Tourism Board will shelve any idea of supporting downtown infrastructure, but that will be the least of our worries.

Most of the big spending “change” projects/programs will have to end. RADTIP, greenways, expanded tranportation program, affordable housing , etc. will all have to be eliminated or severely downsized.

These financial problems will not be unique to Asheville; just that Ashevile is more vulnerable than some cities due to lower population density and a poor economic foundation based on tourism, primarily.

As a community, we will have to accept going back to doing basic government services well and leave the rest. Even that will be a financial challenge.

LOL doom and gloom. Asheville and the South in general are going to be fine. All you Yankees are fleeing the north in seoves. The housing market is still in demand. It’s just now that location and smaller homes are more valuable than bigger ones.

The US economy has reached debt saturation again; although this time at lower interest rates. Auto sales trending down, house sales in most markets flat to down. Student debt at record high. The sad reality is that our economy is in terrible structural shape. Many reasons. But high levels of debt and serious inflation have killed the economy. We have to run $ 1.2 trillion deficits now just to tread water. That is one heck of a stimulus. Imagine our economy with a balanced budget!

Poor management and fiscal irresponsibility. Flags have been raised since 2011, but no action was taken??? Why try and curb wasteful spending when you can just tax more. ” This town needs to be more affordable. I know, lets raise taxes!”

Taxation with poor representation!

Let’s tax ourselves to affordability!

I would be open to raising taxes on non permanent resident property taxes though….