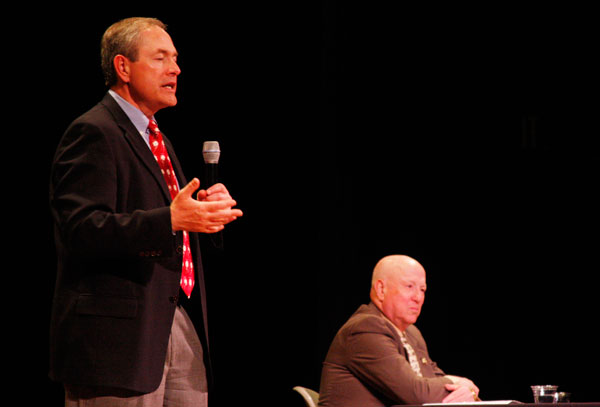

Don’t worry about inflation or oil spikes: The economy is recovering, which will accelerate as the housing market picks back up, but expect unemployment to decline slowly. That was the word from economists David Berson and James Smith at the April 21 Economic Crystal Ball seminar at UNCA.

Before the men spoke, the mostly older audience sipped wine and ate shrimp before filing into Lipinsky Auditorium for the annual event. Bart Boyer, founder of Asheville-based wealth management company and event co-sponsor Parsec Financial greeted the crowd. “Two years ago it was bleak, gloomy, [and] very depressing, but our two world-class economists said [there were] ‘green shoots,’ things were getting better,” Boyer said. “Last year they correctly stated the recession was over [though] the doom and gloomers [claimed] double-dip recession [and said] things are heading back down. Wrong, wrong and wrong again.”

Economics Professor Joe Sulock spoke next and introduced the speakers (full disclosure: Sulock is the father of Xpress A&E Editor Rebecca Sulock). He hit a more pessimistic note, saying, “Supposedly we’re not in a recession. If that’s the case, why do I feel like we are in a recession? The price of oil is trying to cimb Mount Everest, state budgets are in disarray, you’ve got a federal deficit that is alarmingly high, you have a housing market that may be off life support but is hardly full of life. If we’re not in a recession, I ask, where are the jobs?”

Sulock added, in praising Berson and Smith, that “by the end of the evening, I’m sure I’ll be transformed from a befuddled university professor to an enlightened expert on the economy.”

The former chief economist for Fannie Mae, Berson is the chief economist for the PMI Group. Smith is the chief economist for Parsec, but has worked for Union Carbide and the Federal Reserve, among others. A decade ago, the two created an endowment at UNCA and often return for the Crystal Ball seminar.

Berson cautioned that “every forecast an economist or anyone else gives you is going to be wrong, it’s only a question of whether it’s wrong by just a little bit or a lot. Don’t expect that the numbers are right. Hope we get things directionally correct, and the magnitude in the ballpark.”

He also noted that this is the “third consecutive jobless recovery,” after 2001 and 1990-91, adding that despite recovery in the gross domestic product, “we don’t live in a GDP world, we live in an employment world.” That’s why Sulock and others “still feel like we’re in a recession. They’re talking about jobs.”

Still, he predicted “economic growth is accelerating, job growth is accelerating and in the next 12 months, we will see net private increases of 2 to 2 and a half million jobs, and I think that’s being conservative. That’s still not tremendously strong, but it’s better than what we’ve seen for the last two years.”

He said unemployment spikes temporarily as those who have left the job market start looking for work. But that hasn’t happened yet. Bernor said he thinks it will. He predicted an unemployment rate around 7.5 percent during the next 12 months, but that “full employment” going forward would probably be lower due to the length of time many people have been out of work.

While government cuts are necessary in the long run, Berson asserted, in the short run cutting back could actually hamper growth and hold the economy back.

But there’s one sector holding the recovery back, in Berson’s analysis.

“Almost everything has expanded, except for housing,” he said, and the sluggish job growth doesn’t help. But in time it will rebound. “If our outlook on jobs is right, then people will feel more confident about buying a house. The three UNCA students that live together? A year from now, one will buy a house at a great price.”

Smith took a different tack, saying with a some humor, “I know why Joe [Sulock] thinks it’s still a recession: He works for the state, and the state is broke.” He hailed what he called a change in the political conversation, from how much to spend to how much to cut, because “we can’t keep spending the way we have for the last 50 years. Fiscally, we are on the road to oblivion.”

As for the overall economy, “I’m here to convince you things are much better than what you see and hear, that they’re going to continue to get much better.”

Historically, said Smith, quarters of expansion have outnumbered quarters of recessions by 10 to 1, “and [expansion] is likely to continue for at least five to seven years.” He estimated unemployment would be back down to five percent, but “not this year, not next year. We might be there by 2013.”

But “we are not going to be derailed by anything that we know about right now,” he said, dismissing fears about rising energy prices and asserting that increased efficiency makes the country more resilient to oil shocks than before. Nor would the level of government spending, inflation and Japan’s economic problems stop economic growth.

Smith said the economy is on a “two-track recovery” with the first track, big business, doing quite well, but small business remaining “miserable” due to a lack of customers.

That’s a problem, he said, as “small businesspeople are half the GDP. New small businesspeople are most of our entrepreneurs. New businesses create 75 percent of our new jobs in the last five years. We need to get small business with animal spirits of businesspeople behind it, that’s what we need to get the economy going. What can you do?”

With that Smith put a large picture on an overhead of a gorilla, with the word “Shop!” below it.

“Get out and shop,” he emphasized.

While both speakers focused mostly on the overall economy, Smith noted two Asheville metro-area statistics — an average per-capita income of $34,381 and a total of $14.2 billion in personal wealth.

Then, prognostications over, it was question time.

What about China? someone in the audience asked.

“China ought to be our biggest friend and partner,” Smith said. “It’s 1.4 billion people and they want the same thing for themselves and their children we want for ours: a better future.”

The price of gold?

“My friends in the jewelry business think it’s going up and coming down, that’s probably about right,” Smith said.

Berson summed up their overall economic views as “Keynes is right in the long run, Friedman‘s right in the longer run.”

What would they recommend to improve the business climate?

Smith said regulatory reform is necessary, especially for small business, “though we all want clean air, clean water, safe roads.” Berson added that, whatever their particular political beliefs, all the businesspeople he knew had problems with the current regulatory structure.

What about the effect of speculation on food and oil prices?

“This country has a long and honorable history of speculation,” Smith said, noting that several presidents were involved in speculation, and asserting that it keeps the economy flexible. “Speculators keep the markets working smoothly, but everyone likes to blame them.”

What about a rise in taxes, one man asked.

“I’m not a tax expert,” Smith shot back.

Talking to Xpress after the presentation about the quality of jobs and dependence on the service sector, Berson said, “it becomes more bifurcated. You have more lower-paying service jobs and more higher-paying service jobs. In manufacturing, there were fewer differences. What it suggests is, there are even greater dividends to education today than at any time before.”

David Forbes, senior news reporter. Photos by Jonathan Welch

Did they explain the complete failure of their free market nonsense?

[i]the mostly older audience sipped wine and ate shrimp [/i]

Shrimp from the Gulf? Or shipped in from malayisia?

Well, they’re polishing something, and it’s not a crystal ball. Watch interest rates go up. Look for another round of commodity inflation. Watch real estate values go in the tank a second time. Keep a close eye on unsecured credit assets on bank balance sheets, expect round after round of writedowns as unemployed people hit the wall.

If you look at the economy and accept the valuations implicit in the metrics being trotted around, things are peachy. The t**d is, indeed, polished.

http://www.youtube.com/watch?v=KgNzarXntmQ

Amerika’s economy is in the dumper and is not coming back … that is one of the reasons I am moving away … Panama first

There could be a recovery, if anyone would bother getting a handle on the outrageous growth of virtual capital in relation to real capital.

Which would require some pretty heavy regulation on banking and finance.

Which would cripple the top one percent of income earners.

Who have the Congress in their pocket.

And probably the President.

So, you need a cabana boy?

Good post and I agree … this country is doomed … at least in Panama and other places, corruption is affordable for the average citizen … not here in the US though!

It’s not clear to me why anyone listens to “experts” like these anymore. Consumerism has proved to be the problem, not the solution, and for anyone to recommend shopping as a sustainable solution is beyond laughable.

GDP is a false god and the sooner we quit measuring economic success or failure with the GDP, the more likely we’ll be able to create an enduring way of life. Rising per capita GDP is a measure of waste, not success, since the ideal must be to do more with less, not more with more and more and more—if we are going to survive the population spike in mid-century in any form resembling “modernity.”

You lost me at “population spike”.

I will be 99 at mid-century so I might need some help feeding myself.

Right, Mat. I meant to say, “peak.” Human population is expected to top out at around 9 billion in mid-century, depending on the birth rate, of course.