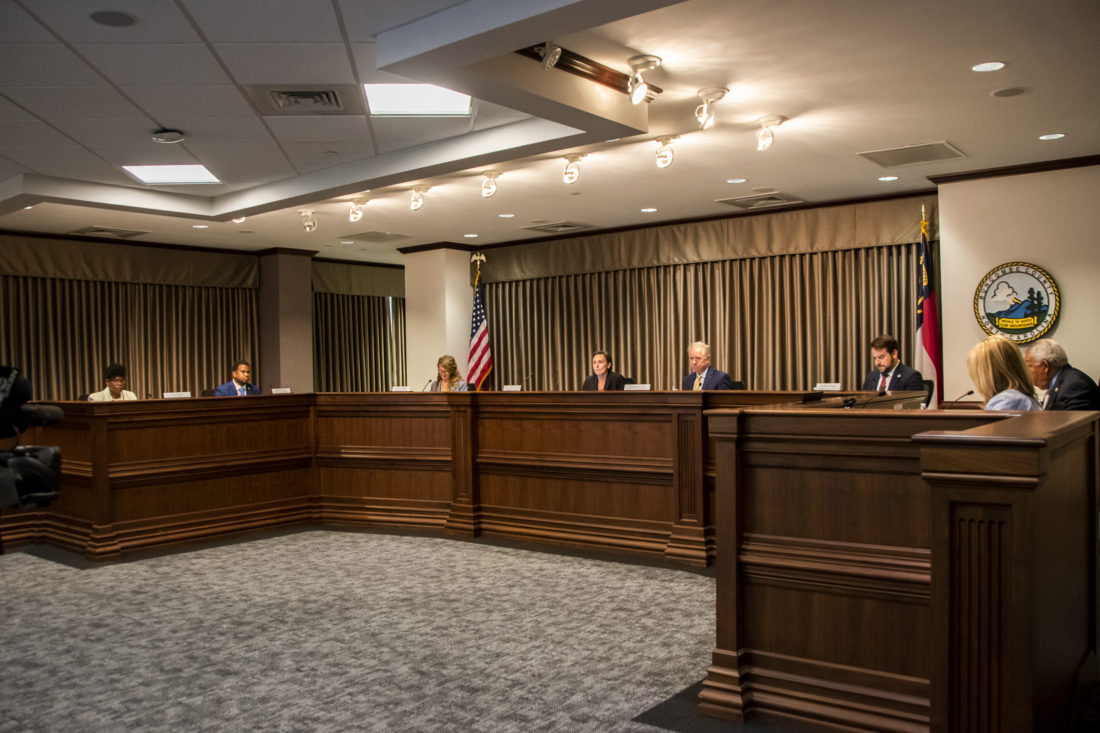

The Buncombe County Board of Commissioners voted unanimously at its regular meeting June 20 to raise the county’s property tax rate to provide increased funding for local school districts.

The $430.4 million general fund budget increases the property tax rate by 1 cent to 49.8 cents per $100 of taxable value, or about 2%. The owner of a home valued at $300,000 will pay about $1,494 in taxes, roughly $30 more than last year.

Commissioners agreed to the tax hike after hearing for months about the struggles of educators to live on salaries set at a statewide base level by North Carolina’s legislature, — they say aren’t keeping pace with Buncombe’s high cost of living. “Public comments that have come through time and again have said, ‘The state has starved us. You have to do what the [N.C. General Assembly] won’t do for us,’” said Commissioner Amanda Edwards about the increase.

According to a presentation by Budget Director John Hudson, the tax increase will raise an extra $5.1 million over the revenues estimated during the June 6 public hearing on County Manager Avril Pinder’s recommended budget. He said the county had freed up another $1 million after revising the budget to no longer support a transit study with the city of Asheville. He also projected an increase in investment earnings and anticipated a $600,000 reduction in debt payments.

The approximately $6.1 million in new funds would be split between Buncombe County Schools and Asheville City Schools and would raise the county’s total allocation for K-12 education to $113.3 million, Hudson said. A-B Tech’s funding would remain at the $8.1 million level outlined in the previously recommended budget.

With the extra funding, board Chair Brownie Newman projected that both BCS and ACS would be able to give teachers a 2% raise in their local supplement, money that districts pay above the state-supported base salary. In their budget requests, however, both school districts had requested enough to provide teachers a 7% raise in local supplement pay.

“I saw the head shaking. I saw that 2% was not what you were hoping to hear tonight,” Edwards acknowledged. “But let me tell you, it took a lot of work on the part of the seven of us to come to that agreement because we know that [some] families will have to start selling off pieces of their land [because of this tax increase],” she continued.

Several members of the all-Democratic board expressed frustration at the Republican-led N.C. General Assembly for not allocating more money for education, putting pressure on county governments to come up with the funds. Commissioner Parker Sloan cited the state constitution, which he argued puts the duty of education funding on the state.

“This did not happen overnight. Our schools are in a staffing crisis, and that started in 2011, when the General Assembly became unified under one political party that does not appreciate democracy. And it sees education as a threat,” he said.

Newman said the decision to raise taxes was difficult because it passes the burden of funding to middle-class homeowners, many of whom are struggling with the same cost-of-living issues that teachers are.

“The issue we wrestled with is not a lack of willingness to increase investments in schools or some kind of ideological opposition to raising taxes,” he said. “I think we’re all behind this budget and committing this funding to teacher pay raises. At the same time, we’re cognizant that we’re basically taking the funds out of other working people’s pockets to do this.”

Beyond education, the fiscal year 2023-24 budget also includes $6.6 million for new spending on public safety, including support for 24 new positions. Another $37.7 million is slated for capital projects, including $15.1 million for repairs to the county courthouse.

Additionally, $12.9 million is set aside for affordable housing bond projects, $3.9 million for pre-K and $700,000 to address homelessness. County employees will receive a 7.28% cost-of-living salary increase.

In other news

Starting next month, it will be more expensive to dump trash at the Buncombe County landfill and transfer station.

As part of the new fee schedule approved unanimously by commissioners for fiscal year 2023-24, landfill tipping fees will go up from $43.75 to $45 per ton. Tipping fees at the transfer station will increase from $47.75 to $52 per ton. (Customers will continue to pay $2 to dispose of each 33-gallon trash bag and $1 per smaller bag.)

The county’s Solid Waste Department will also implement several new fees in the coming months. A new penalty will double the base tipping fee for any load containing more than 5% by weight or volume of certain recyclable materials, said Dane Pederson, Buncombe’s solid waste director.

According to a June 20 presentation, 15% of residential waste and more than 40% of construction waste dumped at the landfill consists either of recyclables or wood suitable for mulching, motivating staff to crack down on mixed-waste loads. The fee will become effective in September after an education campaign and a month of warnings to those disposing of waste, Pederson said.

There will also be new flat fees — $10 or $25 depending on the size and type of vehicle hauling the trash — for residents delivering unsecured loads of garbage to the landfill. Those fees will be in place starting in August.

Let’s keep one fact on the table. According to Newman, Buncombe county has the second highest education budget in the State (out of 100 counties). However, North Carolina is ranked #48 in the nation. The county supplements the state budget to get the county to near the national average. Here’s my problem: we have two school systems tasked to be combined. We’re not reaping any benefits to reduce administrative head count that could be achieved in a combined system (less administrative overhead, less record keeping, less IT support). I did hear from the commissioners talking about “it was a tough discussion.” However, I didn’t hear from our elected officials “I’ll take the lead” in getting the combined school system reform done and a timeline. The lack of time and commitment to address this complex issue is a problem. If school vouchers are here and a threat to reduce the education budget, we should be more prepared.

Yep, it seems like two educational administrations have a fair amount of redundancy and reducing this would result in some quick cash on hand. I would target the Administrative and Managerial levels first…those would yield the most money ! !

While the Board might have struggled to come to an agreement for a tax increase…a 2% increase is funny…not funny ha-ha but funny in the sense that county employees are receiving a 7.28% increase !! Doesn’t matter that it is called a ” local supplement increase ” or a ” cost-of-living increase ” 7% is greater than 2%.

Yup, combining the two is the only logical solution. You can bet it’s the administrators who are kicking and screaming against it, as half of them would be redundant. They are the highest paid and the least important. Politicians need to step up to actual leadership status and make this happen! Otherwise, stop whining about lack of funds. Asheville already pays laughably high prop taxes.

Maybe the Tourists could kick in some cash.

“Citing education “ has always been a great excuse. The funds just always seem to disappear…