Raise taxes, make cuts, use funds from the city’s rainy day fund or any combination thereof.

Those were the choices laid before Asheville City Council during an April 9 budget work session after members learned that a 4.11% pay raise for city employees next fiscal year would drive the city’s undesignated general fund balance below its preferred minimum.

According to Just Economics of Western North Carolina, a single person working full time in Buncombe County needs to make $22.10 per hour to afford basic expenses in 2024. Some city employees make less than that.

During the work session, city Finance Director Tony McDowell explained that city staff recommends a 4.11% raise for all city employees for the upcoming budget cycle, which would bring the lowest-paid employees from $37,960 to $39,520 per year. That pay rate falls in line with Just Economics’ living wage pledge, a tiered certification that allows employers to remain in the Living Wage Program if they agree to pay a $19 per hour rate while committing to annual increases toward the new $22.10 rate.

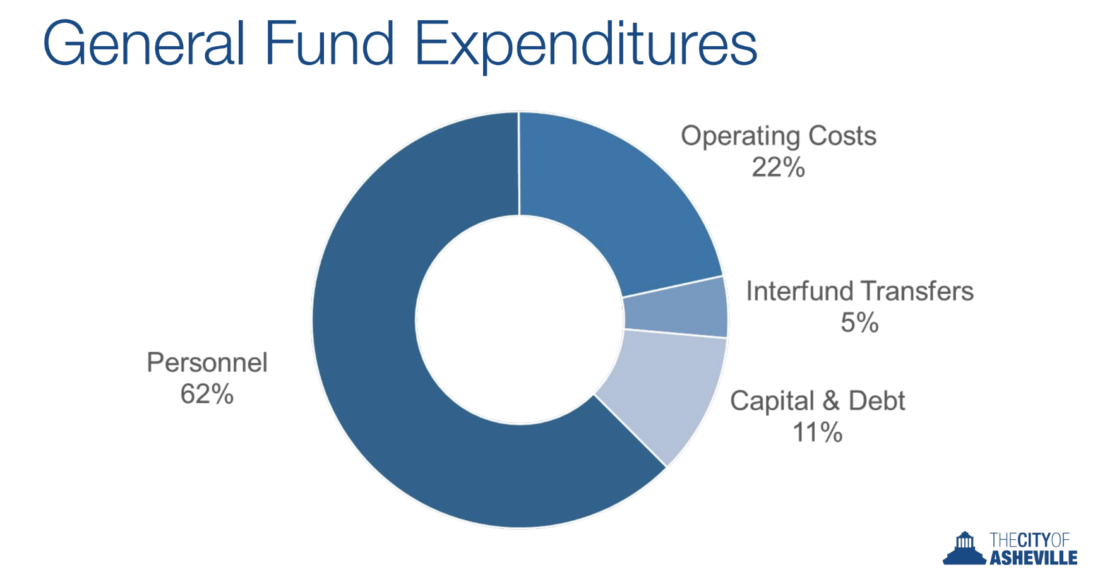

Employee compensation makes up 62% of the city’s general fund budget. City Manager Debra Campbell said that the pay raises were crucial for the city to continue recruiting and retaining staff across all departments.

Council also reviewed other types of pay increases, including flat rate payments for all city employees regardless of position, and a hefty 21% raise for all employees to meet this year’s full living wage, but McDowell pointed out that those options were either too costly or caused compression issues, which occurs when there’s little difference in pay between employees, regardless of differences in their respective responsibilities, knowledge or experience.

City staff also recommended increases to city employees’ health benefits by $2.1 million, of which roughly $775,000 would come from the city’s general fund.

Raising salaries by 4.11% and covering the increasing cost of employee health care amount to $4.6 million. Those costs and other expenses would pull a total of $8.1 million from the city’s general fund.

That level of spending, said McDowell, would put the city’s undesignated fund balance below its desired 15% of the fund’s total budget. Essentially, the general fund is the city’s checkbook, which is primarily funded by property taxes and fees. Other money, such as from specific project funding, grants or debt, is kept in different accounts.

Asheville has maintained the 15% undesignated fund balance policy for the last several years to cover unforeseen revenue fluctuations and unanticipated expenditures. The N.C. Local Government Commission recommends that municipalities maintain at least 8% of the adopted general fund budget as undesignated funds, but there is no state minimum requirement.

“Hopefully, after we make decisions around compensation, the fund balance might come in around 13% or 14%,” said McDowell.

Dipping into the city’s undesignated fund balance drew concern from several members of Council.

“That gets me a little bit worried because one of the rules is don’t use your fund balance for recurring expenses because you essentially cannot count on that [next year],” said Mayor Esther Manheimer. “That makes me concerned about overall sustainability.”

“I mean, I’m not sure what the solution is, because I’m just getting these numbers. But I’m concerned that we are dipping into fund balance for payroll,” added Council member Sage Turner.

“Say we do it,” Council member Maggie Ullman posed. “What do we do next year?”

One tool that Council could use to pay for the raises is a property tax increase. That idea was also unpopular among Council members, though some acknowledged that they had few options.

Campbell said that she and city staffers were not recommending a tax increase on top of the recently approved increases for city fees and charges; a $150 million in general obligation bonds proposal that would impact taxpayers over the next four years; and the possibility of a business improvement district that would tax property owners located in downtown Asheville.

One factor that might help is the fact that Buncombe County will be reappraising all properties in the county in 2025 to update property taxes. Manheimer pointed out that the likely property value increase will generate more revenue for the city without having to raise the tax rate.

“We believe, to maintain employee morale, to retain the employees that we have, we have got to provide a salary increase. Obviously, it’s not as much as we would like. It’s not as much as we did last year, but it’s what we think we can afford with the use of fund balance,” Campbell maintained. “And no, it isn’t best practice. But it’s all we got.”

The Tuesday work session was the last of five sessions and other budget-related meetings since Council began its budget process in December. Campbell will present the proposed budget to Council at its meeting Tuesday, May 14. A public hearing on the budget is slated for Tuesday, May 28, with budget adoption scheduled for Tuesday, June 11.

Hopefully this quote from the mayor is a misquote

“ One factor that might help is the fact that Buncombe County will be reappraising all properties in the county in 2025 to update property taxes. Manheimer pointed out that the likely property value increase will generate more revenue for the city without having to raise the tax rate”.

If your property value has doubled since the last evaluation and the tax rate stay’s the same it would double your property tax.

Anything that’s not revenue neutral is a tax increase no matter how the good mayor describes it.

Excellent comment/insight.

I expect that the Mayor is thinking in terms of being able to tell taxpayers that their tax RATE will be reduced without emphasizing that their overall tax bill will rise some.

I can’t imagine they will leave the tax rate the same as the new assessments are very likely to be considerably higher that previous.

I would like to dream of a reduced tax rate, but I don’t foresee that coming. The new assessments will almost certainly impose another onerous burden on property owners. Because, unlike other jurisdictions where certain levels are grandfathered to help lessen the ridiculous jumps amongst long-term property owners, this jurisdiction has simply allowed such a turnover and increase in property values that it has forced certain owners out in favor of transplants throwing cash around. It is a shame that towns such as this cannot try to sustain new growth and population without casting aside those that were here.

A few more USTA banners oughta fix everything…

My daughter lives in Bend, Oregon. The state has a very interesting property tax model.. Basically, increases are severely limited and not tied to property values. This greatly helps those that are not part of the buy-up crowd. Since this approach greatly reduces municipal revenue, the rest of municipal funding comes from specific referendums on things like parks, programs, etc. Also, the state allows occupancy taxes to be used by the city’s that have them. In Bend’s case (much like Asehville a big tourist destination), the 6% occupancy tax all goes tot he city coffers for basic services like police, fire, etc.

Not a perfect system, but intersting to know how others deal with these issues.

The housing crisis is the result of policies that Clinton enacted to make all things housing an “industry”. He suceeded beyond his wildest dreams. And of course, so much so that a lot of unintended consequences have arisen. The other factor is the inflationary policies of our federal government and those have been utilized to essentially allow the US to live beyond it’s productive means. At least that’s how I see it.

Here’s a novel idea– cut expenses! Eliminate a job per floor of each building the County and the City operate. If each job paid $40000 per year, between salary and benefits that can be real money.