“Getting to revenue-neutral probably is not realistic, as much as I’d love to do that.” — Commission Chair Brownie Newman

“When you look at 2018, I don’t believe we can lower [the property tax rate] to revenue-neutral and fund requests related to core services.” — County Manager Wanda Greene

The Buncombe County Board of Commissioners did not take any official action on the proposed budget during a nearly five-hour meeting Tuesday, June 6. However, the property tax rate picture became a bit clearer as talks revealed that achieving a revenue-neutral rate is likely not in the cards.

Community chest

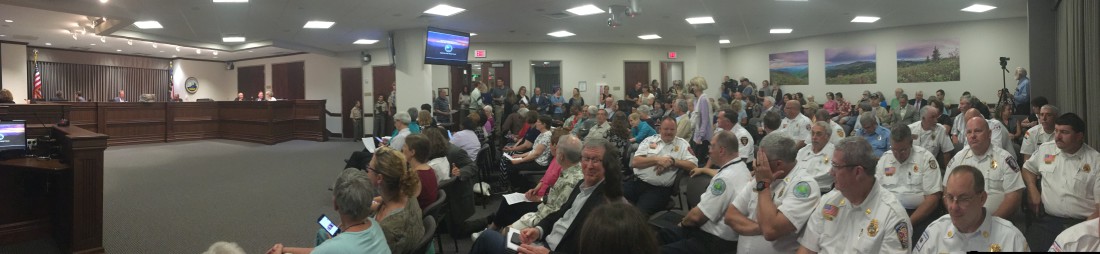

The meeting opened with nearly two hours of open public comment as about 50 people waited to speak their mind on various issues like climate change and development concerns. A large number of people speaking were representing nonprofits that potentially stand to be beneficiaries of community funding grants or receive money via contracted services.

Robin Merrell, with Pisgah Legal Services, explained that some previous donors would not be contributing because of various reasons. She noted that county support is paramount: “We may lose $550,000 in funding from other sources. We have laid off one staff member, we may have to lay off more. We can’t afford to lose our funding from you.”

“We can solve food insecurity. The investment you have made has made a difference,” explained MANNA FoodBank’s Katy German.

However, not everyone was looking to ask for money as Carl Mumpower, chairman of the Buncombe County Republican Party, asked commissioners to be careful with taxpayer dollars. He said the county’s growth is a blessing and a concern and asked commissioners to “take advantage of the recent property revaluation by not adding an additional tax burden.”

“There are 45,000 Republicans I represent tonight who would appreciate that,” he noted.

To that end, this year’s property revaluation shows that the county’s property tax base now stands at about $31.5 billion. That’s up by $6.8 billion, a 28 percent increase from the county’s 2013 assessment, which valued taxable property at $24.7 billion.

At this rate

The proposed budget for fiscal year 2018, starting July 1, is $419,289,728. That dollar amount is an increase of $5.7 million, or 1.4 percent, over the current budget. It has a property tax rate of 55.9 cents per $100 of valued property, or $1,118 for a home valued at $200,000. A revenue-neutral rate would be 51.3 cents, and would equal a $1,026 bill for a home valued at $200,000.

“I’ve heard very clearly that we need to bring that rate down,” said County Manager Wanda Greene in reference to the 55.9 rate.

County resident Roy Harrison said that rate affects his long-term plans. “I have a concern, and it is that I’m retired. … Am I going to stay in Buncombe County? That’s one question I’m asking. Can I afford to stay in Buncombe County?” he pondered.

“These budget considerations have a great effect on me, people of my age, people of color … as we go forward, I’ll be watching.”

Commissioner Robert Pressley said he wished the property tax rate could go as low as 50 cents. “Most commissioners know my big concern is what we are going to do with elderly. A lot own their property but don’t actually own it because they are making [tax] payments every year,” he lamented.

Greene then said she doesn’t believe revenue-neutral is possible while maintaining a required level of funding in core services. She also went on to urge commissioners to work with the N.C. General Assembly to raise the property tax exemption rate for the elderly population. Greene said the current required income level of around $29,000 for those exemptions does not reflect the reality of living in Buncombe County. “It’s time to take a look at that. It’s been about 10 years since we got that exemption,” she noted, adding that she thinks the income requirement could definitely be increased.

Commissioner Joe Belcher addressed the multitude of funding requests. “There are those that have come here tonight that are passionate about things; it doesn’t mean those will be funded at the level requested,” he explained. “The need is great, and the requests are multiplying year after year. We have to make decisions and say where we are comfortable with the tax rate.”

Commissioner Chair Brownie Newman said he wants the rate below 55.9 cents. “The question is how low can we go while doing the things we want to do. We also need to look into the future and set a tax rate as low as we can go, but one that is sustainable and that preserves the triple-A bond rating,” he said.

“Getting to revenue-neutral probably is not realistic, as much as I’d love to do that.”

Commissioners are set to discuss and approve the budget at their next meeting Tuesday, June 20.

For more information about the budget process, see Xpress‘ previous coverage below:

- Overview of nearly $11 million requested by nonprofits

- Budget talks spark old beef, new tax rate discussion

- Schools may be key to property tax relief

- County nonprofit funding at odds with resolution guidelines

Can the County say no to any of the groups coming with their hand out, waiting to put it in our pockets?

“Don’t hold your breath,” says county.

Time to start an investigation of Newman.

I’ve heard he has a storage locker just filled with undelivered mail.

Has anyone bothered to ask him how he become a millionaire while in office? I don’t have much faith on actually holding the little crook accountable because for some odd reason partisan politics are above the law here. But all it takes is one whistleblower and he’s toast.

https://www.statista.com/statistics/232859/global-solar-pv-market-size/

“A lot own their property but don’t actually own it because they are making [tax] payments every year”

Uh, is someone going to tell Mr Pressley what “ownership” means?

When someone explains to you cronyism, corruption, and waste. Your friends in the other thread blatantly stayed that such thing permeates in local government because of the southern culture. And yet government here is filled by outsiders LOL. So in other words they stand by fraud perpetuated by the likes of Newman and Greene. Par for the course for you folks.

blah blah blah blah boooooooring. Get a new schtick, because your current one is an ongoing shambles.

Some states lean towards taxing income. Other states favor taxing purchases. All states tax ownership of real estate.

Either Mr Pressley hasn’t had this gently explained to him or all that exposure to lead in exhaust fumes during his NASCAR days has taken its toll. In a county where renters consistently get the shaft, whether in Asheville or beyond, the complaints of old property owners sitting on six-figure unearned capital gains deserve the world’s tiniest violin.

Uh, is someone going to tell Mr Pressley what “ownership” means?

Be gentle. Commissioner Pressley’s head has been knocked around more than a few times.

Top 5 Robert Pressley Crashes

https://www.youtube.com/watch?v=mzbht8lL2zg

LOL makes fun of bringing about poverty because he views southerners with disdain.

Yeah right – because complaining about taxes is a “southern” thing? Nobody likes taxes.

And I only hold a few, specific southerners with disdain.

LOL scam.

LOL 4 years before a required valuation. And of course increases. LOL scam.

And yet doesn’t explain why property owners are on the hook for multi million dollar corporations who use tax money bribes as a means of making bank.

No one has yet to explain why the need for reevaluations 4 years before they were due. But of course it’s smoke and mirrors for tax increases. Which the crooks were too scared of simply raising without the property value excuses. This is how the crooks operate. And they’re hurting a lot of people to keep the farce going.

It’s been explained countless times, but since listening would get in the way of your repetitive rants, you didn’t bother.

Strange how someone with a schtick about being a blue-collar native wants the out-of-towner LLCs who own booming primo downtown real estate to get a massive tax break at the expense of owners of small homes in the county.

Actually, city residents pay an absurd share of the county costs for which they receive reduced benefit.

Why, for example, is the county rate the same for Asheville residents as for unincorporated county residents when they receive a different set of services. Asheville residents have to pay for their own police services, whereas county (only) residents are serviced by the sheriffs department which is paid for by all.

City residents get screwed.

Exactly. And not one crook on council is working to correct that.

bsummers

2 days ago

Be gentle. Commissioner Pressley’s head has been knocked around more than a few times.

bsummers

2 days ago

And I only hold a few, specific southerners with disdain.

[“Thank you for being part of this effort to promote respectful discussion.”]

Does T-Peck believe that property taxes should continue to exist? Yes or no.

Give him some time, Luther. It takes him a while to adjust to the new time zone when he posts here.

How about having the Business of Religion start paying their fair share?