There’s more to solar energy than residential and utility-scale investments: Community-scale solar projects are a growing financial segment in both North Carolina and the nation. And among those projects, faith-based initiatives, sometimes termed “creation care” projects, are also gaining ground.

“As people of faith have become more deeply engaged in environmental stewardship, we now recognize that rapidly accelerating climate change is one of the greatest challenges that civilization has ever faced. Putting together faith and the scientific reality of climate change, congregations are taking action,” Susannah Tuttle, executive director of N.C. Interfaith Power and Light, told about 70 attendees at Celebration Solar Soiree, held Aug. 25 at Lenoir-Rhyne University in Asheville and sponsored by the Self-Help Credit Union.

“Some [congregatons] are doing energy audits and making steps to reduce energy use, some are designing new buildings and additions that are highly energy efficient, and some are making the transition to clean, renewable energy generated from the sun,” Tuttle said.

But the expense poses challenges to nonprofit religious institutions hoping to transition to solar. North Carolina currently offers tax incentives that, along with the federal incentives, have supported solar projects in the taxpaying-public and business arenas, but it has taken time to develop models that provide incentives to nonprofit religious institutions.

Several viable models have emerged that are attractive to religious congregations, including:

- the LLC model used by the Community Church in Chapel Hill and the Highland United Methodist Church in Raleigh;

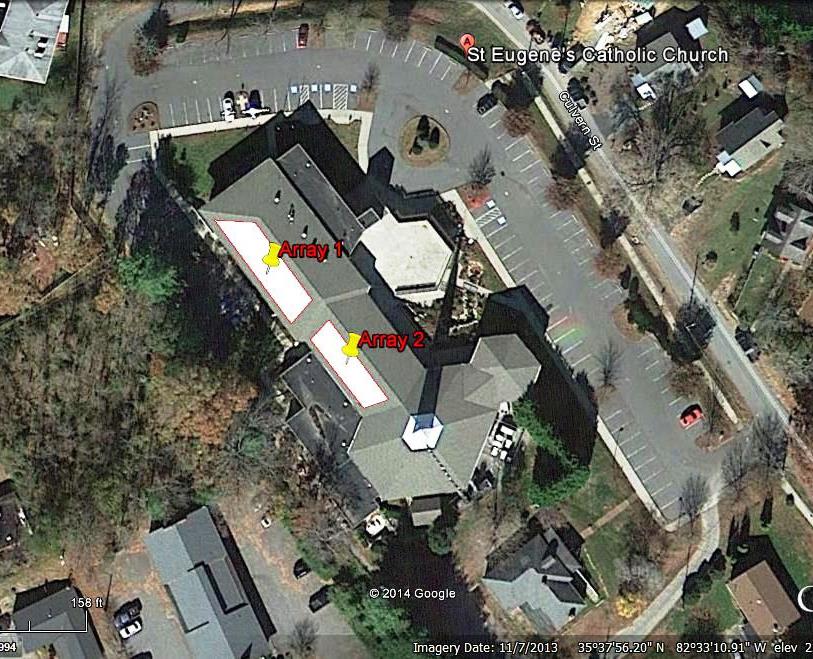

- the individual-donor model employed by the United Church of Chapel Hill, Temple Emanuel in Greensboro, St. Eugene’s Catholic Church in Asheville, Kehillah Synagogue in Chapel Hill, and West Raleigh Presbyterian Church; and

- several donation models, such as the capital campaign at United Church of Chapel Hill, crowd-sourcing at Community United Church of Christ in Raleigh, and grant-funding at Myers Park Baptist Church in Charlotte.

More congregations are likely to opt for one or more of these as models, if the N.C. General Assembly votes this month to extend current tax credits and incentives beyond 2015.

Uncertainty for solar in North Carolina

“Time may be running out on the North Carolina tax credits, and it may not be possible for these congregations to put their faith into action,” Tuttle said. “That is why we encourage the legislature to extend the credits through 2017. Some models are able to use both federal and state tax credits (LLC model), but many more can only use the state tax credits (like UCCH) making them especially important. Therefore, an extension of the tax credits would allow many more faith communities to put their “faith into action” on this most serious of moral and environmental challenges, benefiting from the ground work and models developed by the trailblazer congregations.”

InterFaith Power & Light decided to join with solar installers because it wants to show lawmakers what the renewable energy tax credit means to an often overlooked customer base, Tuttle said. “It’s taken years for many [congregations] to get to the point where they are ready to move forward with installation. But if the tax credits are not continued, those projects will just stop,” she noted.

A partnership between the religious organizations and solar installers has emerged, growing out of conversations about the tax credit’s role in getting rooftop projects going on places of worship, said Yes! Solar CEO Kathy Miller. “Everyone is talking about the solar farms and what will happen to them. But we thought it was important to highlight what the tax credit means to the end-user,” Miller said.

The loss of solar tax credits in North Carolina would have significant impacts on more than faith-based models, according to a group of North Carolina residential solar installers who teamed up with representatives of the religious community to make the case to the N.C. General Assembly that without the tax credit, the companies will lose out on hundreds of installation jobs, millions of dollars in revenue and negatively impact North Carolina’s economy and business environment.

The coalition has urged the General Assembly to pass a two-year extension to the tax credit and the phase it out over time. The group includes Baker Renewable Energy, Southern Energy Management, Sundance Power Systems, Yes! Solar Solutions, along with Kehillah Synagogue and the United Church of Chapel Hill.

It is unclear, as of this writing, if the General Assembly will extend the tax credit. The House included an extension in its budget proposal, but the Senate did not. This year’s legislative session has been extended, yet again, to Sept. 18, as budget negotiations continue between the House and Senate. With the two chambers still working on a compromise, it remains to be seen whether the tax credit will be included in whatever deal is reached.

While some policy observers say that ending the tax credits would not significantly impact the commercial, utility-scale solar industry, they caution that it would be a devastating blow to the residential, roof-top and community-level solar industry in North Carolina.

“At some point solar tax credits will be phased out, that’s not the issue,” declared Dave Hollister, co-owner of Sundance Power Systems. “But cutting them out abruptly will disrupt a huge portion of the solar energy industry in North Carolina, cost thousands of jobs and set back goals for a clean energy future immediately. When the billions in tax credits, subsidies and support for oil, gas, coal and nuclear power are phased out, then it’s the right time to end support for solar. All we are saying is give us a chance to compete and to grow clean energy in North Carolina.”

> “faith and {…} climate change”

Two things that require supernatural forces to be real.

Climate change is a subject that is based in science. Faith is based on things that cannot be demonstrated by science. I don’t see how someone with any knowledge of the subject could suggest that they are equivalent. The climate is changing, the earth is getting warmer, and human greenhouse gas emissions are affecting the underlying natural climate variation. These are scientific facts widely observed and documented.

Thanks for the Rational Response(s) to the comments from HuhHuh and OneWhoKnows. As author of the article, was reluctant to engage such obviously absurd and inaccurate comments. I respect all opinions, but do hold they should be based on facts and logic. As Thomas Paine is quoted,… “To argue with a person who has renounced the use of reason is like administering medicine to the dead” .

It is time to END this taxpayer fleecing to prop up solar BS from which fat cats like Brownie Newman are getting RICH !!!

ENOUGH of this BS !!!

The greater subsidy is the hidden subsidy for fossil fuels, which come from the enormous damages that they cause and will cause in the future. Until this greater subsidy is neutralized (preferably through a fee on carbon) the various tax benefits for renewable energy are completely justified.